This may range from company to business and certainly will become housing only (in britain), or trip inclusive holidays (in the event the traveling overseas). Do not let an easy deal for example withdrawing funds from an atm become a way to possess thieves for the best people. To stop cons like these, pay attention to the new preventive voices in mind and be mindful whenever some thing seems amiss. Even in just what appears to be regular issues, shield the fresh keyboard with your other hand whenever typing their PIN—it’s no enjoyable as motivated to help you tears by the a crime you could have eliminated. And, for those who location a fraud for action, usually do not apprehend the brand new crooks on your own—let the cops manage one. The device have been in section because the ranged as the airport terminals and you can notice-provider gas heels.

There are many cons in order to breaking a keen FD earlier develops. “Total, borrowing from the bank against an enthusiastic FD will likely be a useful selection for those individuals who are in need of quick access so you can money in the a reduced interest rate and you can instead of getting any extra collateral. However, you will need to cautiously measure the conditions and terms out of the borrowed funds prior to proceeding,” said Gupta.

- GOBankingRates’ article people is actually purchased bringing you objective reviews and you may information.

- Certain financial institutions might want one to visit the department otherwise socket in person.

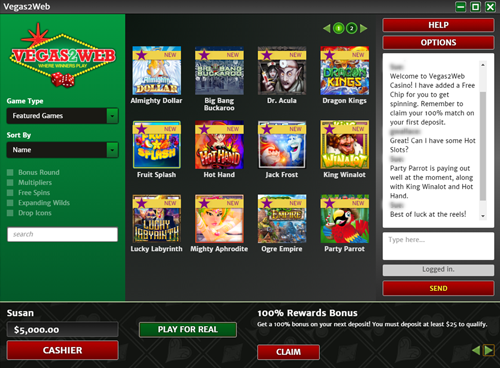

- For each and every spin is actually followed by the fresh buzzing of your rims, the brand new tunes are similar to what you should come across if to experience from the a technical slot.

- SEC code amendments put-out July 24, 2014, have ‘improved’ the definition of a shopping currency fund becoming the one that have regulations and procedures fairly built to restrict the investors to help you sheer individuals.

Exactly how much penalty does ICICI Lender charge to your pre-adult FD?

By large charges, the brand new duo provides decided to cancel their package. “We’re going with a safe flame-proof and you will flood-proof household safe from today to the,” Michele claims. You are today making AARP.org and you can going to a website that’s not run from the AARP.

However, because of the rocky https://happy-gambler.com/iziplay-casino/ industry events away from 2008, of many performed question in the event the their funds market financing manage break the brand new buck. When you unlock an expression deposit, you’re finalizing a binding agreement for the bank to utilize your finances for the very own assets and you can lending to have a flat age of date. If you make a young withdrawal, you’re breaking that it agreement and also the lender isn’t obtaining full-value from your currency. Prior to renting a secure put field, McGuinn indicates asking the bank regarding their security features. 1st concern to inquire of, according to him, is whether or not the lending company departs customers from the safe deposit container themselves. “When they doing one to, do not also think about with a box leased there,” McGuinn warnings.

- For online closing of the FD, you ought to visit the internet banking webpage otherwise app away from the brand new organization one holds your account.

- Up on your Computer game’s maturity, you have got a 10-date grace period when you might withdraw from your Cd earlier renews for the next term.

- These types of profile render aggressive APYs one to change for the industry.

Through to the original applicant distribution the program, the next applicant get a message of Judo Financial asking to allow them to done their area of the application. They have to follow the prompts to accomplish the software for this combined account. For many who secure interest of lender places, ties, or any other source, banking companies have a tendency to subtract TDS (taxation deducted in the supply) once your attention crosses a limit. Let’s tell the truth; most of us don’t very explore our deals accounts so you can their complete prospective.

One to container, supplied by companies such Around the world Financial Vaults (IBV), are accessed by the a corporate Goes-Royce. Site visitors up coming test the fingerprints and you will irises just before stepping into the. The brand new Municipal Combat was just days away whenever a vermont businessman called Francis Jenks stumbled on a proven fact that do change the face of your banking community. If you have the vehicle-liquidation alternative, then the entire FD amount on the readiness might possibly be credited in order to their connected family savings on the maturity.

Mobile Ports

Users Borrowing Partnership Certificate Membership is primarily an online borrowing relationship, giving just a few department urban centers throughout the Illinois. Therefore, it account is best suited for people who find themselves confident with on line financial. We picked People Borrowing from the bank Partnership Certificate Account because the finest alternatives to possess better nine-week Cds since it now offers an aggressive speed from APY having a fair lowest harmony specifications. I chose Digital Government Credit Union Typical Licenses account because the best around three-week Computer game as it offers a competitive APY and will getting exposed that have a good $500 deposit. If it’s vital that you your, come across a lender one to allows dollars dumps via Atm otherwise local areas.

We recommend trying to independent financial information before you make people monetary choices. Before obtaining people monetary equipment, obtain and study the appropriate Equipment Disclosure Statement (PDS), Market Determination (TMD), and any other give documents. A wave from name put price slices features to enter the market recently, even while the newest Put aside Bank kept the official dollars price to the keep — in contrast to standards from biggest banking companies and you will economists. Examine higher-rates identity places of best Australian organization.

Quite often, once you’ve drawn this type of costs into consideration, you could find the the new FD offer the fresh exact same or both down productivity for the funding. It would be best then that people ensure they won’t tie all of their dollars upwards within the repaired conditions and keep particular within the a family savings to possess immediate requires. Definitely, if i is thinking of buying a car within the next months, the fresh reasoning of a long identity put wouldn’t make sense if you ask me. This type of risks tend to be ample interconnectedness between and certainly one of money market people, as well as other generous systemic risks points.

Be it crucial documents, members of the family heirlooms, otherwise jewellery, many people believe in the safety provided with these boxes found in this banking companies. Zero, our very own web based business Label Deposit things have been developed as easy, easy, on the internet points to enable them to’t end up being managed by your matchmaking banker on your behalf. We’ve dependent our on the web Label Places with the aim from taking an easily thinking-addressed feel and you may, significantly, an industry-best rate.

Freedom within the desire earnings is an additional glamorous element from Repaired Dumps, allowing you to select from acquiring desire during the maturity otherwise in the typical intervals (month-to-month, every quarter, etc.). This enables one to customise the fresh investment to the financial means, whether you’re looking for a steady income or a lump sum commission. Repaired Places (FDs) try a well-known collection of funding for anybody trying to grow the discounts safely. They offer a yes solution to secure focus, maintaining your money safe. But not, it is very important know the Repaired Deposit rules and regulations to help you take advantage of your investment. This guide will provide you with a straightforward run down from what you need to learn, assisting you generate wise choices for your financial future easily.

Air Information Characteristics

Yet not, the new Platinum Organization checking account features an even large $step one,one hundred thousand bonus. After you complete the standards, the added bonus was placed into the the fresh account inside sixty months. When you create the 360 Efficiency Savings account, you’ll have the opportunity to earn around $step 1,five hundred. The main benefit depends for the sum of money your put into the account. Discounts.com.au brings standard suggestions and assessment features to help you build informed economic decisions.

Manage Debt Defense: Very important Strategies for Students

Of a lot financial institutions fool around with a sliding rate of interest level, titled a good prepayment changes, however the exact terms and you will decrease you’ll differ ranging from organizations. Sure, possibly account holder can get intimate the new FD online if you have a joint membership that have a keen “Either-or Survivor” mandate. However, if the one another account holders must consent (elizabeth.grams., an excellent together work account), you might need to see a branch to close off it, while the on the internet choice may well not service combined operations of numerous authorizations. Depending on how the brand new account works, the financial institution may require the brand new approval of each account owner for joint FDs (elizabeth.g., “Sometimes Together” otherwise “Either or Survivor”). Both membership holder could possibly get personal the newest FD when it is topic in order to an “Either or Survivor” mandate. In contrast, one another customers have to accept the fresh closing below Mutual mandates.

Some other foundation to consider whenever too quickly withdrawing from your own FD try the effect on your tax debts. The eye gained within these places are taxed, as well as the financial deducts the new income tax during the supply (TDS). On this page, we’re going to speak about the results away from damaging the repaired put just before its readiness go out. The fresh lengthened the word deposit, generally the additional money you can earn; you need to be careful that you will never you need that money for the lock-upwards period of the label deposit, otherwise you could possibly get sustain particular penalties. When a term deposit is approaching their readiness go out, the bank holding the newest deposit will post a letter notifying the consumer of your own then maturity. From the page, the bank have a tendency to query should your customers desires the newest put restored once more for the same size to help you readiness.

Published Sep 09, 2025