In this final article of the series, we dive more deeply into the concept of digital services and the potential they offer to close gender data gaps not just across areas of natural resource management, but in women’s financial inclusion and the gender digital divide.

How digital services can help close multiple gender data gaps

Much like small-scale farmers, (where the body of research on digital services in international development efforts has been focused to date) small-scale fishers struggle with a lot of the same challenges— lack of business capital, lack of market access, lower resilience to shocks, higher exposure to the impacts of climate change on their livelihoods, and high rates of poverty, to name a few. Last year, Future of Fish explored how digital services can promote positive socio-ecological outcomes in small-scale fisheries. This is especially true for women involved in fisheries.

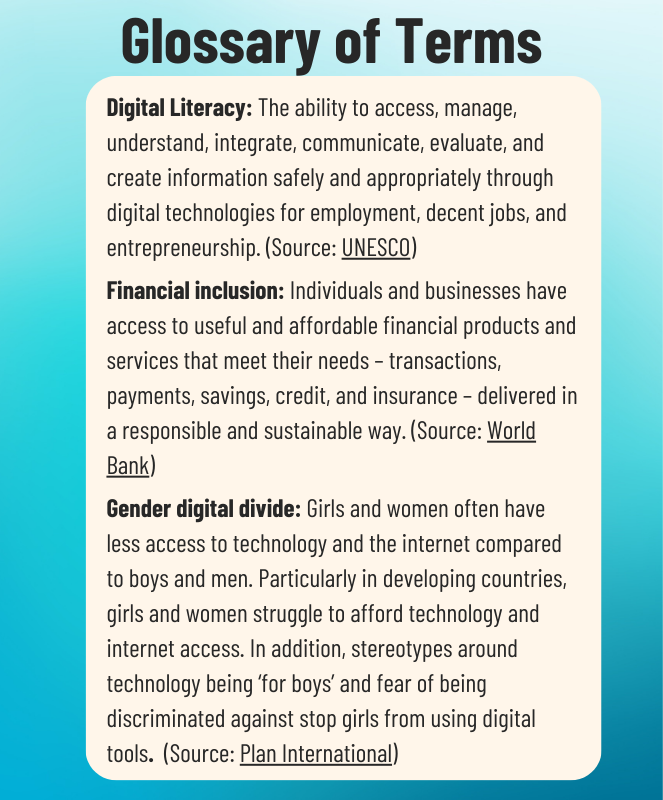

What are digital services? Digital services refer to the delivery of services using digital technologies such as the Internet, mobile networks, and smartphone applications. Digital services are characterized by their ability to be accessed remotely, on-demand, and often in real-time, making them highly convenient and accessible to users, especially those based in rural and remote areas. They can also be personalized and customized to meet individual user needs, providing a more tailored experience. Digital services are often delivered through a subscription-based model or on a pay-per-use basis and are typically accessible from a range of devices, including computers, tablets, and smartphones. In a fisheries context, Future of Fish sees the potential of digital services to include a wide range of offerings such as a secure chain of custody, extension services, technical assistance, fisher associative capabilities via e-communications, online market access, remote financial services, and many others. Our team believes digital services are a crucial tool that can usher in multiple, interconnected solutions in seafood resource management while enhancing the social outcomes and livelihoods of those working in blue foods.

As part of these social outcomes, we recognize the power of digital services to help close gender data gaps across natural resource management, digital literacy, access to financial services, and economic growth. Along with generating the missing data that more broadly captures women’s contributions to marine resource management as discussed in the Valuing Invisible Catches article, integrated, interoperable digital services support better business practices, including greater transparency and formalization in the sector, and support financial inclusion with access to markets, business credit, and a mobile money wallet. As they have shown promise in small-scale farming, we theorize that integrated or “bundled digital services” as they are referred to in the literature, could have an even greater multiplier effect in addressing the compounding vulnerabilities of small-scale seafood producers.

The integration of digital financial services in particular will help users to overcome the many barriers to entry of traditional financial services for unbanked populations, to which female seafood workers frequently belong. Digital financial services on the other hand provide a more inclusive avenue for the unbanked, with little to no money required to activate an account and lower transaction costs to borrow, send, and receive payments between users. Digital financial services are also safer, negating the need to travel to a physical bank or to travel with cash on one’s person, all important factors to people who live in remote areas, especially women. UN Women’s 2019 working paper, Leveraging digital finance for gender equality and women’s empowerment states that evidence shows some early positive signs that mobile money accounts might be helping to close the gender gap when it comes to inclusion in the financial sector.

Promoting the adoption of bundled digital services in the seafood space will bring clarity to natural resource management and financial inclusion while actively working to bridge the gender digital divide. This comes at a critical time when the GSMA Mobile Gender Gap report has noted a slowdown and in some cases reversal in the numbers of women accessing mobile internet, the primary way people in LMICs access the internet. Expanding mobile access goes hand in hand with much more than entertainment, but access to information and improved livelihoods with 64 percent of working women in 11 LMICs having greater access to business and employment opportunities because of mobile phone technologies.

Image Credit: UN Women, “Learn the facts: Rural women and Girls”

A compelling anecdote on the potential of digital services to empower female fish workers comes from Rare’s previous work in Honduras with the OurFish app. When bad weather impacted catch for several days in a row, fishmonger Zulma Lopez was able to resort to her financial statements saved in OurFish to help her access a loan to withstand hard times. The fact that Zulma had generated this digital registry was advantageous, as seafood transactions in LMICs continue to be largely cash-based, which are then recorded in a paper ledger, if at all. Armed with screenshots of past monthly transactions to demonstrate her usual steady income, Zulma was able to secure a loan of $400 at Banrural in her municipality. This was Zulma’s first time accessing credit for her business as well as her first time accessing financial products from a formal institution. Before this instance, Zulma had been limited to taking out loans at predatory interest rates from money lenders in her community. The interest rate on her formal Banrural loan was only one-quarter of what the rate she’d normally received in the past with the local money lenders. Such exploitative interest rates keep seafood workers, (especially women who tend to work in the least remunerated parts of the seafood value chain), in a cycle of poverty. Empowering more women with a suite of digital business tools like those described in Zulma’s story could help lift female fish workers out of poverty and build more lasting financial resilience against the impacts of shocks, which are increasingly felt by those whose livelihoods are entwined with the unpredictability of natural resources in a changing climate.

Adopting digital services in small-scale seafood operations could build a solid foundation of gender-specific data for better measuring SDG 14: life below water that takes into account how women participate in, manage, and benefit from marine resources. Moreover, if integrated with interoperable business and financial services, bundled digital services could also support gender-specific data collection for SDG 9: industry, innovation, and infrastructure, and SDG 12: responsible consumption and production, two additional SDGs that currently lack gender-specific indicators.

With the SDGs in dire need of reinvigoration, it is more important than ever to advance solutions that address simultaneous issues. The mounting pressures of climate change on the financial resilience of women working in natural resources is one such issue. At the same time, the continuing lack of gender-specific data across six of the seventeen SDGs, a preeminent global development framework, cannot be left neglected.

Published Sep 08, 2023